An Update on DSP Pension Fund’s Underperformance

I’ll start with a confession: underperformance bothers me. Not because my livelihood depends on beating a benchmark, but because I genuinely love investing. It’s the one thing I sometimes feel I can do with a bit of competence—and falling short makes me pause and reflect, sometimes uncomfortably.

Why are our equity schemes underperforming

Recently, this is a question we have been asked several times on different occasions.

Last year, in our half yearly update and our annual update, we communicated that we are fine with the underperformance if it is an alternative to taking undue risk. We stand by this dictum. At the time, we were outperforming the benchmark and all our peers on every metric by a wide margin. We are somewhere in the middle today, but we continue to believe what we communicated. Embedding margin of Safety at every step of our investing process is not a passing “view” we flip against; it’s a principle with which we invest and operate.

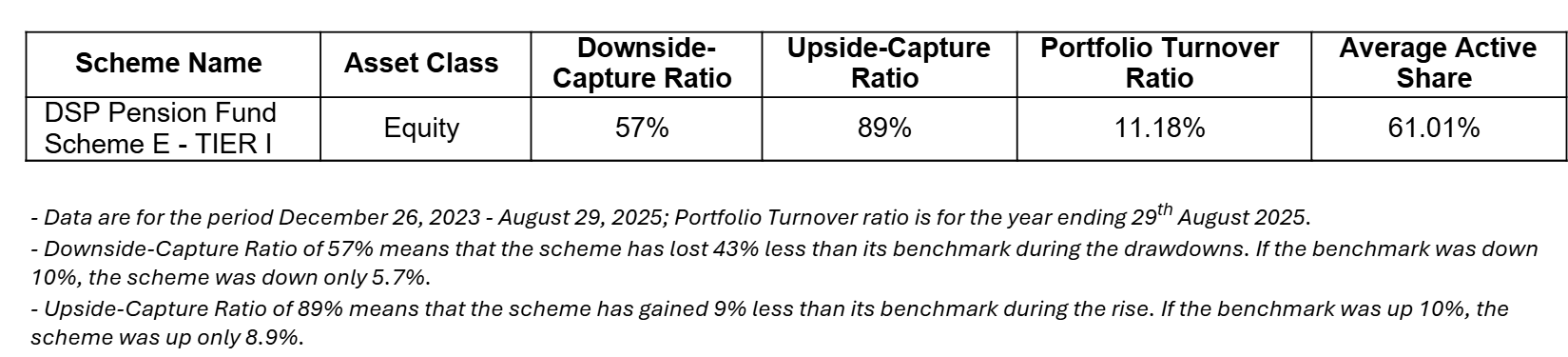

In this update, we are primarily going to focus on our Equity Scheme under Tier I that comprise ~47% of our subscribers’ equity capital managed by us.

From 26th December 2023 (our inception) to 31st August 2025, our Equity Tier I scheme has outperformed the S&P BSE 200 benchmark by 634 basis points (6.34%) annualized. During this time, we have not chased any momentum but stayed anchored to our investing framework: buying good businesses at reasonable prices, maintaining discipline, and protecting the downside.

As it’s been only a short time that we have been managing your money, you can rationally ignore our outperformance. But if you have any interest in investing with us, read our investment framework, half-yearly update and annual update. If you like what you read, we believe that you would have a reasonably fine investing experience with us over next several years.

Now, if you zoom in since 1st March 2025, we have underperformed the benchmark and all our peers. That may continue for a while – at least until we get a meaningful drawdown or market staying sideways for more than a year. Based on my experience, the latter tends to unnerve more people than the former.

Why could our underperformance continue for sometime?

- We hold ~10% cash, the regulatory maximum for Tier I schemes.

- We own 25 businesses, not 71 – the industry average.

- We are conservative by design — focused on margin of safety, not maximizing near-term returns.

At first glance, this conservatism looks like a handicap, but it may not be so. We are behaving the same way we behaved last year. In a market where nearly everything has gone up, cash drags and concentrated discipline feel like a burden. We are not making excuses, but we will nearly always underperform in such market conditions, as we are short-term conservative and long-term aggressive. Today, we keep positioning ourselves in investments that will probably go down less than the others during any drawdown. As your fund manager, this is not an exciting position to be in, but we believe it is prudent to act this way.

Margin of Safety Is Not About Today

Valuations across Indian equities remain elevated. The S&P BSE 200 trades at ~24x earnings and near 4.3x book value. This is high compared not only with its historical means and medians but also on an absolute basis.

In such periods, the probability distribution of outcomes shifts. Upside shrinks, while the risk of drawdowns grows. Holding cash in these moments isn’t a “call” on the market. It is simply an act of confession that we don’t know the future with any certainty. It is building in an admission that prices may not be offering us enough cushion for long-term compounding.

In markets, avoiding ruin matters more than capturing every rally. As Ed Thorp wrote, “You don’t have to play every hand — just the ones where the odds are in your favour.”

Incerto in Practice

We can’t buy cheap derivatives, as Taleb does. But our framework draws inspiration from the idea that some systems benefit from disorder. For investors, this means:

- Avoiding Fragility: We stay away from highly leveraged, momentum-driven, or valuation-stretched businesses. These do well in calm waters but break in storms.

- Owning Businesses that Strengthen in Tough Times: We prefer companies with strong balance sheets, durable moats, and managements who opportunistically think long term.

- Keeping Optionality: Note that our cash has delivered nearly 200 basis points higher returns than our equity benchmark in the last 1 year. Our ~10% cash is not dead money. It is optionality that allows us to act when volatility delivers bargains.

This approach works slowly, then suddenly. For months it may feel boring or cautious. Then in a sharp correction, the asymmetry reveals itself.

We are by no means bullish or bearish. We just believe that the current market is not offering reasonable number of businesses in our coverage universe – that offer reasonable risk/reward.

Why We Invite Patience

If you’re judging us, please don’t use one quarter, or even a year, as the yardstick. You can completely disregard our performance track record. If you do, judge us by asking the following:

- Have we stayed true to our framework?

- Have we protected downside when it mattered?

- Are we positioned for compounding over decades, not months?

We are not in the business of entertainment. We are in the business of stewarding your retirement corpus with discipline. That means being willing to look “wrong” in the short term in order to be right over the long haul.

In Closing

Whichever fund house you choose, decide with care and then give your chosen manager the years it takes for results to bear fruit. Chasing last year’s winners or moving back and forth between funds does not create wealth; it only leaves you with less than the fund itself earns and adds needless strain on both you and the manager.

We cannot promise you outperformance every few months or even a couple years. In fact, we guarantee the opposite: there will be phases like the one we are in now, where our peers will do better. But what we can promise is this:

- We will not chase fancies of markets.

- We will not risk permanent loss of capital.

- We will remain patient, disciplined and decisive.

And when the market eventually gives us an opportunity, as it always does, it is highly probable that we will be able to showcase further why our approach works.